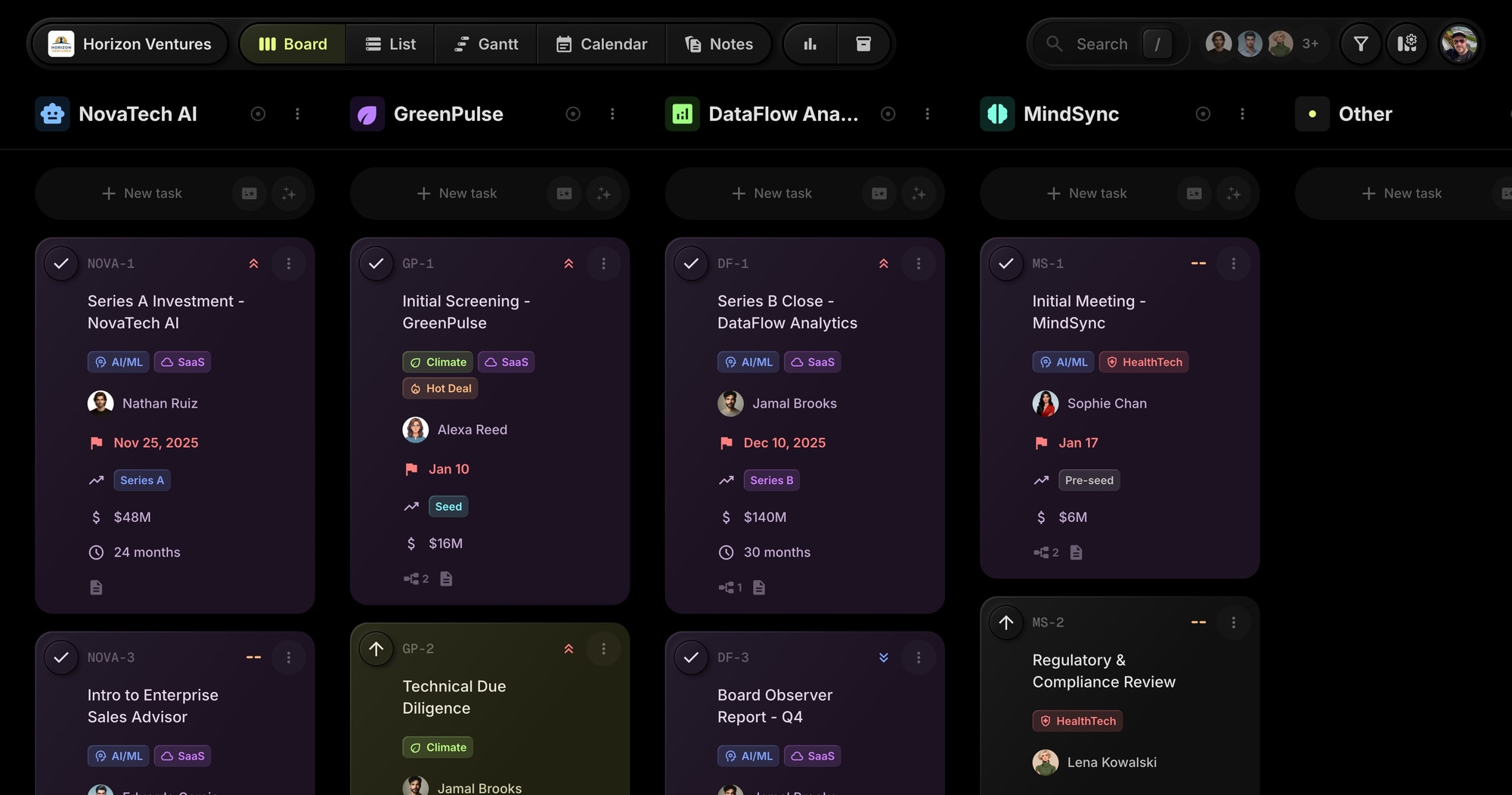

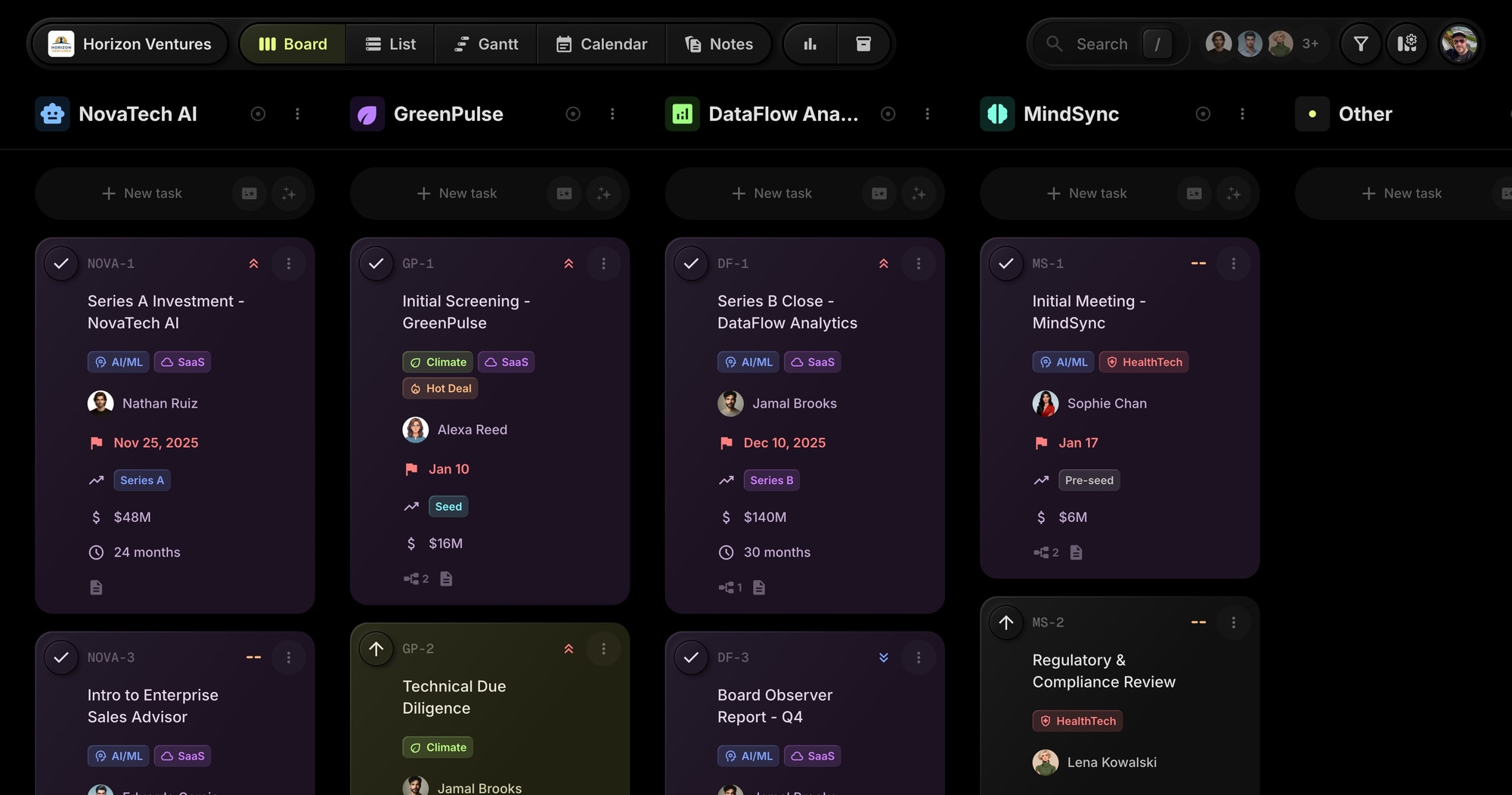

Horizon Ventures - VC Deal Pipeline Project Management Template

The Horizon Ventures template gives venture capital teams a ready-to-use deal pipeline board. Track startups from initial screening through due diligence to portfolio management - with funding stage properties, valuation tracking, and investment committee workflows built in.

#Who This Template Is For

- Venture capital funds managing deal flow and portfolio companies

- Angel investors tracking multiple investment opportunities

- Investment analysts conducting due diligence

- Fund partners coordinating IC presentations and votes

- Family offices with startup investment programs

#Pain Points This Template Solves

VC teams lose deals when pipeline visibility is poor. Founders wait too long for decisions. Due diligence tasks slip through the cracks. Portfolio company updates get lost in email.

Without a central system, partners can't see deal status, analysts duplicate work, and promising startups choose competitors who move faster.

#Why Deal Flow Management Matters For VCs

Speed wins deals. The best companies have multiple term sheets. When Sequoia or a16z can move from first meeting to term sheet in two weeks, slower firms get left behind. Systematic deal flow management eliminates the bottlenecks that cost you competitive deals.

The numbers define the game. A typical seed fund reviews 1,000+ companies annually, takes meetings with 200, conducts diligence on 30, and invests in 10. Without a system to manage this funnel, promising deals get lost in the noise.

Portfolio value creation requires structure. Post-investment, the real work begins. Board preparation, follow-on decisions, founder support, exit planning - these activities compound returns. Firms that treat portfolio management as an afterthought leave value on the table.

Institutional memory matters. Why did you pass on that company three years ago? What did diligence reveal about that market? When these answers live in partners' heads and old emails, every deal starts from scratch. Centralized deal history accelerates future decisions.

#What's Included In This Template

#Pre-Built Projects

| Project | Icon | Purpose |

|---|---|---|

| NovaTech AI | Smart Toy | Series A portfolio company - AI/ML SaaS |

| GreenPulse | Eco | Seed stage - Climate tech due diligence |

| DataFlow Analytics | Analytics | Series B portfolio - Data infrastructure |

| MindSync | Neurology | Pre-seed pipeline - HealthTech evaluation |

#Status Columns

- Pipeline - Initial screening and evaluation

- Due Diligence - Active technical and market analysis

- Term Sheet - Negotiating investment terms

- Funded - Investment closed, now portfolio company

- Portfolio - Active portfolio management

- Exited - Successful exits and returns

#Custom Properties

- Funding Stage (Select) - Pre-seed, Seed, Series A, Series B, Series C

- Valuation (Number) - Post-money valuation in millions with $ prefix

- Runway (Number) - Months of runway remaining

#Tags

- AI/ML (blue) - Artificial intelligence and machine learning

- FinTech (green) - Financial technology

- HealthTech (red) - Healthcare technology

- Climate (lime) - Climate and sustainability

- SaaS (purple) - Software as a service

- Hot Deal (orange) - High-priority opportunities

#Sample Tasks and Dependencies

The template includes realistic VC workflows. Initial screening leads to technical due diligence and customer reference calls. Market analysis and customer calls must complete before IC presentation. Board meeting prep triggers Series B planning.

#How To Use This Template

#1. Create Your Board

Sign up for t0ggles and create a new board using the Horizon Ventures template. Your deal pipeline structure is ready immediately.

#2. Add Your Deals

Create projects for each company you're evaluating or have invested in. Use the template's structure as a starting point - one project per company keeps everything organized.

#3. Track Due Diligence

Break down due diligence into discrete tasks: technical review, customer calls, market analysis, legal review. Use task dependencies to ensure work happens in the right order.

#4. Manage Your Portfolio

Move funded companies to Portfolio status. Create recurring tasks for board meetings, quarterly reviews, and follow-on investment decisions. Use notes for investment memos and research.

#5. Prepare IC Presentations

Track all the work that feeds into investment committee presentations. Use dependencies to ensure customer calls, technical DD, and market analysis complete before the IC meeting.

#Best Practices For VC Deal Management

#Standardize Your Screening Criteria

Every firm has an investment thesis, but many apply it inconsistently. Document what moves a deal from Pipeline to Due Diligence. Is it team background? Market size? Revenue traction? Write it down so the entire team applies the same filter.

Tip: Create a screening checklist in Notes. Reference it when reviewing new deals. Consistent criteria means faster decisions and less time debating borderline companies.

#Time-Box Due Diligence

Deals die in diligence. The best companies have options and won't wait forever. Set clear timelines: technical review in one week, customer calls in two weeks, IC presentation by week three.

Tip: Use start and due dates on diligence tasks. Track overdue items in your weekly pipeline review. If a deal is stuck, either accelerate it or pass.

#Log Everything

In venture, relationships span decades. The seed company you pass on today might be a Series B rocket ship in three years. The founder who doesn't work out might start something better next time.

Tip: Record meeting notes in task comments. Document why you passed on companies. Your board becomes institutional memory that survives partner turnover.

#Monitor Portfolio Health Proactively

Companies that fail often show warning signs months in advance: slowing growth, key departures, rising burn. Proactive monitoring lets you intervene early or cut losses.

Tip: Update Runway monthly for all portfolio companies. Set a saved filter for "Runway < 6 months" to surface companies needing attention. Review portfolio health in weekly partner meetings.

#Key t0ggles Features For Venture Capital

- Custom properties - Track funding stage, valuation, and runway

- Task dependencies - Model DD workflows and IC preparation

- Notes - Store investment memos and market research

- Project-specific access - Keep deal details confidential within the team

- Calendar view - Track board meetings and key dates

#Common VC Workflow Challenges

#The Overwhelmed Partner

Partners see hundreds of companies annually. Without filtering, everything feels urgent. High-potential deals get the same attention as obvious passes.

Solution: Pipeline status is your first filter. Only companies that pass initial screening move to Due Diligence. The Hot Deal tag marks genuinely urgent opportunities. Partners focus on diligence and term sheet deals; analysts handle pipeline screening.

#The Lost Deal History

"Did we look at this company before?" "Why did we pass?" When this information lives in old emails and partner memories, you waste time rediscovering context.

Solution: Every company becomes a project. Meeting notes live in comments. Pass reasons are documented. When a company comes back around, you have full history at a glance.

#The Chaotic IC Process

Investment committee meetings should be decisive. Instead, they're often a scramble: "Did we finish customer calls?" "Where's the market analysis?" "What's the final ask?"

Solution: Create an IC Prep task with dependencies on all required diligence items. The task only becomes unblocked when customer calls, technical review, and market analysis are complete. No more surprises at IC.

#The Neglected Portfolio

Once the deal closes, the work should intensify. But without systems, portfolio companies get attention only when they're raising or failing.

Solution: Each portfolio company is a project. Recurring tasks for board prep, quarterly reviews, and founder check-ins ensure consistent engagement. The Runway property surfaces companies needing attention before they're in crisis.

#Investment Workflow Patterns

#The Weekly Pipeline Review

Most firms meet weekly to review deal flow. This template supports that workflow:

- Filter by Pipeline status to see new inbound

- Review each deal against screening criteria

- Move promising deals to Due Diligence with assigned analyst

- Pass on deals that don't fit - document why

- Review Hot Deals requiring immediate attention

#The Due Diligence Sprint

When you decide to dig deeper, move fast:

- Create diligence tasks: technical review, customer calls, market analysis, legal review

- Set dependencies so customer calls happen after initial analysis

- Assign owners and due dates

- IC Prep task depends on all diligence completing

- Weekly check-ins until IC presentation

#The Portfolio Cadence

Consistent portfolio engagement compounds returns:

- Monthly: Update Runway and key metrics for all companies

- Quarterly: Deep review of each portfolio company

- Pre-board: Create board prep task with presentation dependencies

- Annual: Portfolio review for follow-on decisions

#Try The Template

Streamline your deal flow and portfolio management. Horizon Ventures gives you funding stage tracking, due diligence workflows, and investment committee coordination from day one.

View the demo board to see it in action, or Start Your Free Trial.

#Related Resources

#Use Cases

#Similar Templates

- GreenPath ESG - Sustainability consulting

- Viva Metric - SaaS product development

- Web Innovate Studio - Client project management

#Documentation

#External Resources

- National Venture Capital Association - VC industry resources

- AngelList - Startup and investor platform

Don't Miss What's Next

Get updates, design tips, and sneak peeks at upcoming features delivered straight to your inbox.